Dear Reader,

This is the Tesla Model 3 battery…

It charges in eight hours…

Lasts 300 miles on a single charge…

And has a lifespan of 500,000 miles…

No EV battery has yet to compete with this one-ton powerhouse.

But believe it or not, it’s about to be replaced by batteries that use a new type of lithium-ion cell.

Tesla may even end up using these new cells.

Not only do they allow batteries to charge in minutes and store twice as much lithium in their anodes, they also:

- Eliminate the well-known fire danger associated with current lithium-ion batteries

- Work for smartphones, laptops, and wearable devices

- And have been rigorously tested and adopted by the US Army

Perhaps more importantly, they can be produced via existing lithium-ion manufacturing facilities in a drop-in process.

This is crucial for any battery improvement because of the great amount of sunk capital that has already gone into the build-out of lithium-ion facilities. Any new tech has to play nice with the existing infrastructure.

And this company’s new cell technology does just that.

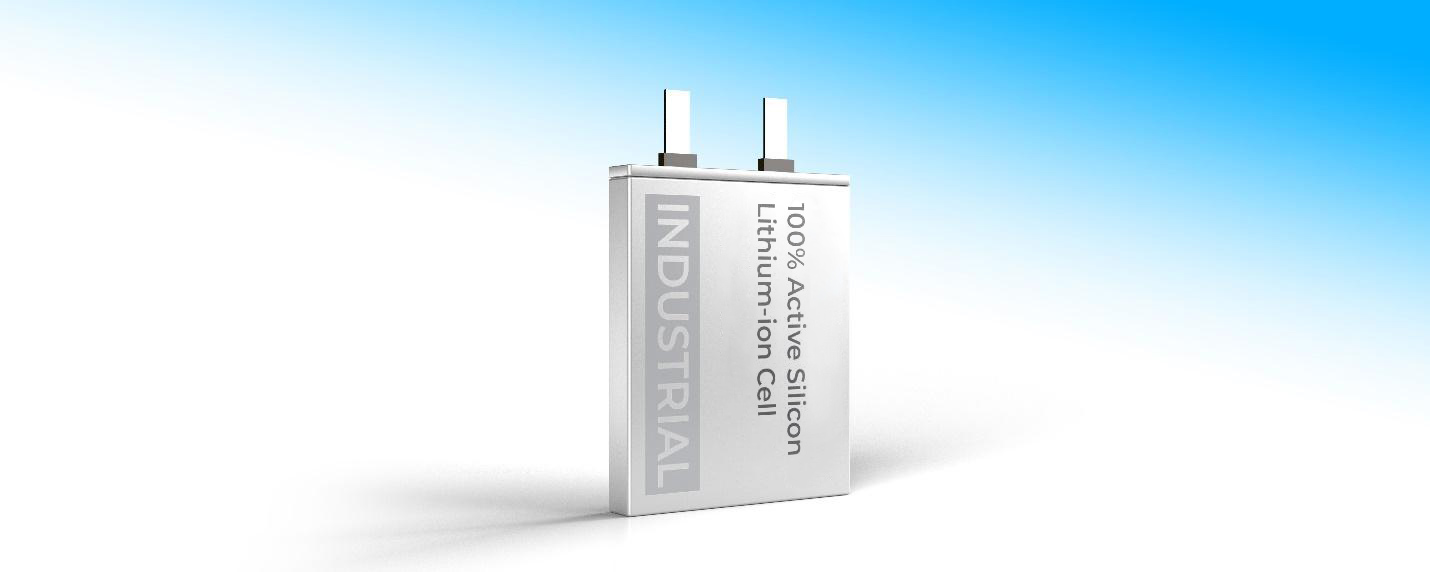

All with a device that fits in the palm of your hand…

This new battery cell is the catalyst that will launch the battery of the future.

I think it’s the needed improvement that will lead to mass adoption of electric vehicles.

But EVs are only part of this story…

This battery is also capable of powering the devices needed for:

- The $30 trillion AI revolution

- The $12 trillion Internet of Things

- The entire $40 trillion clean energy transition…

Megatrends worth nearly $100 trillion…

The secret inside this next-generation battery tech can provide ALL the power they need…

Today, you’ll discover the innovation making this possible… one so powerful that it’s protected by not one, but 94 different patents.

Most importantly, you’ll discover the company that owns ALL of these patents, giving it the KEY to the trillion-dollar battery revolution.

It’s not Tesla or any big company you’ve heard of.

Rather, it’s a little-known California company … headed by a legendary tech billionaire.

He got his start as an engineer and founded a semiconductor company that went public at $73 million in market value.

In 2019, the company sold for $10 BILLION (with a “b”).

That’s a 13,000% gain from inception.

Good enough to turn every $1,000 invested into over $130,000.

In his next endeavor, he did even better.

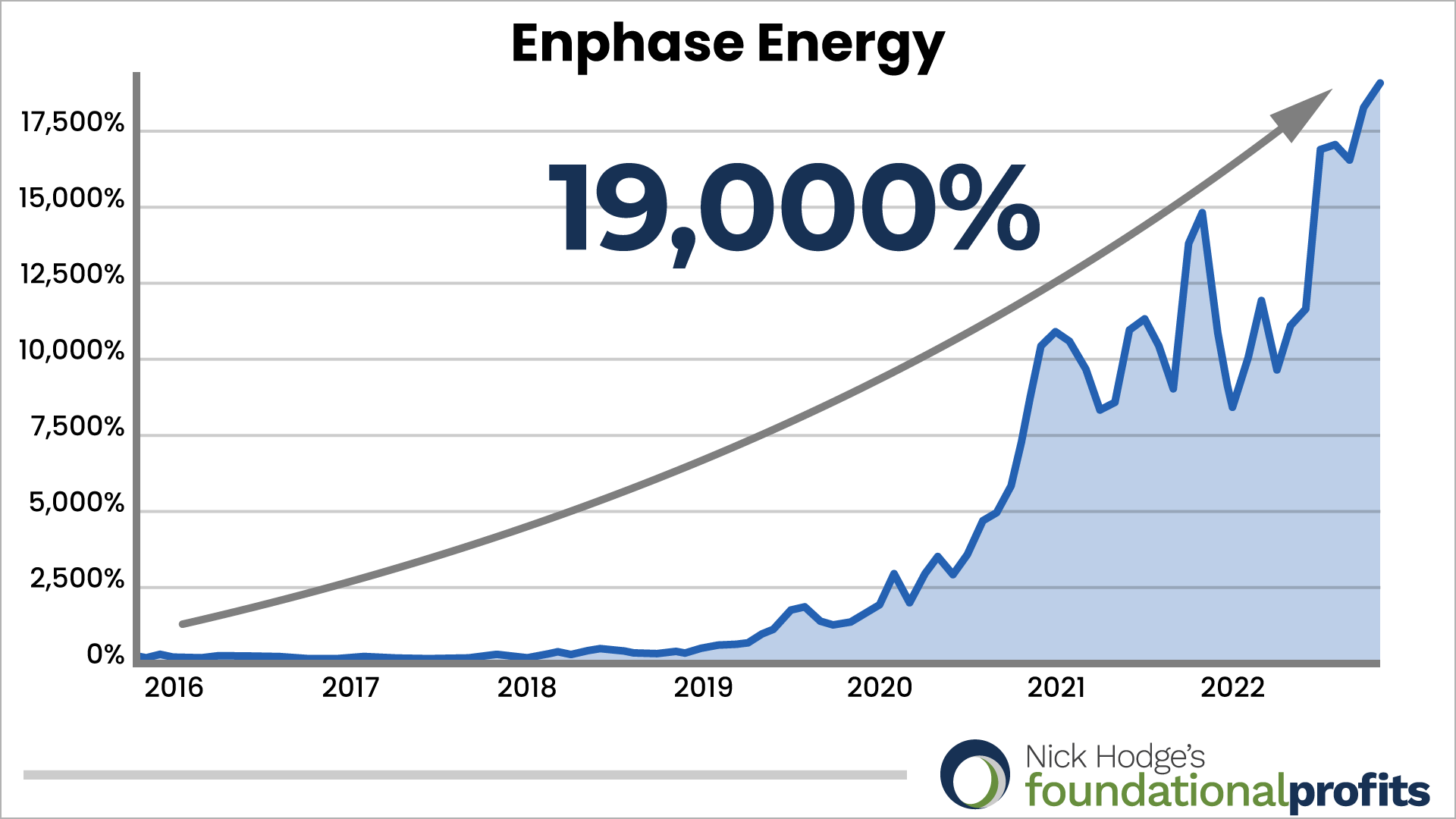

He took over a solar company on the verge of bankruptcy and transformed it into a $20 billion juggernaut.

Investors got rich in the process as the stock soared over 19,000% in a few short years, making Enphase Energy the single-best-performing stock in the S&P over the past five years.

That’s good enough to turn every $1,000 invested into over $190,000.

Now he’s gearing up for his next big success, one far bigger than anything he’s done yet…

And you can buy into his new company now while it’s still on the ground floor…

While shares trade for only $10!

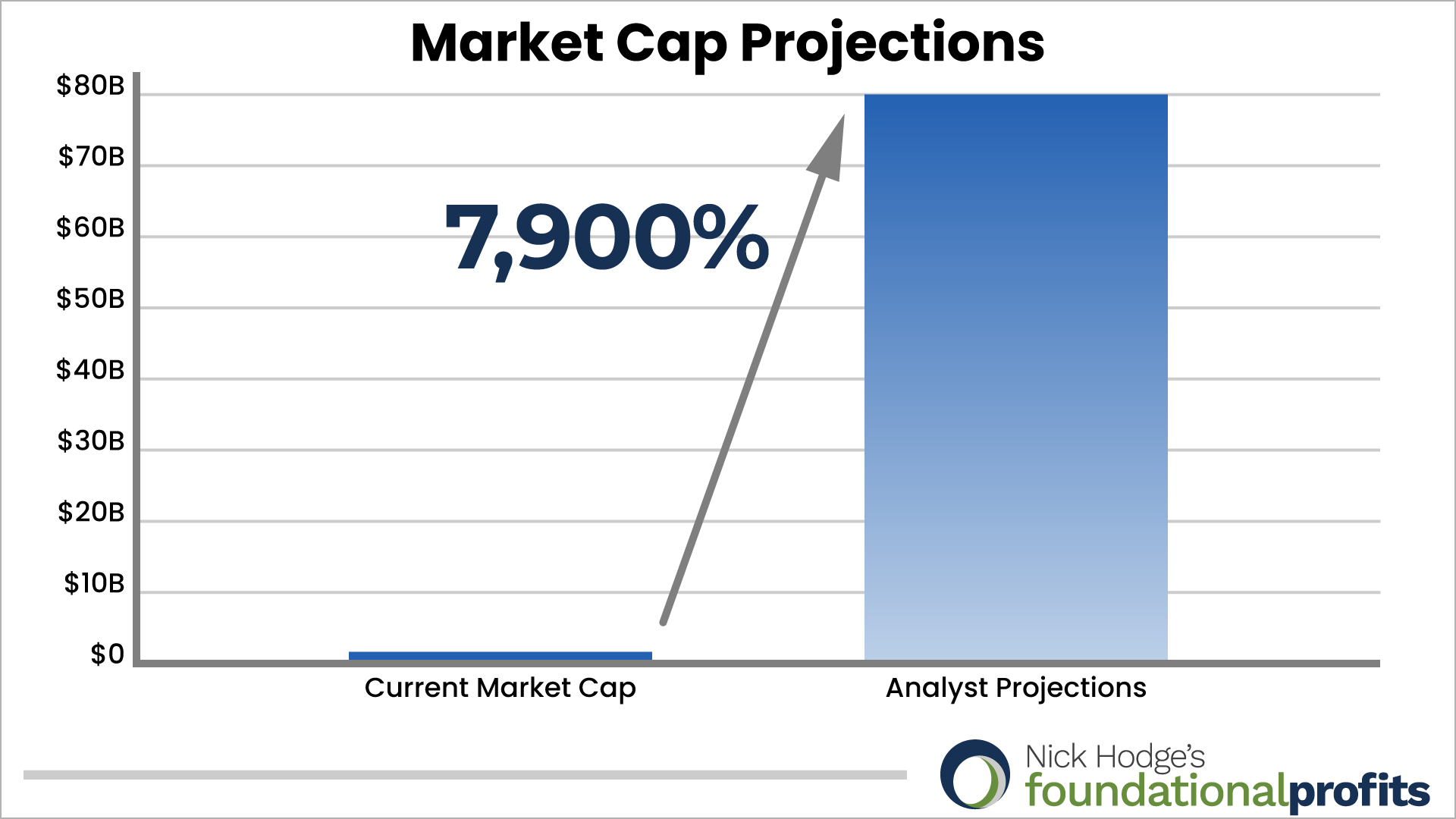

Right now this company’s market cap is a mere $1 billion, but I don’t think that’s going to last long.

According to Loop Capital, this company could take a trip to $80 billion in value…

Giving investors who buy now 7,900% gains on the ride.

And that’s a very conservative projection, as you’re about to see.

Today, you’ll get all of the details on this opportunity in a new report I’ve compiled exclusively for you – and you’ll get it free of charge the moment you become a lifetime member of Foundational Profits.

But first, let me explain the magnitude of this technological breakthrough…

As you’re about to discover, the opportunity is so big that famed short-seller Marc Cohodes…

The man who accurately predicted the collapse of FTX and Signature Bank…

Is making a rare long call on this company, predicting it will become…

“A Generational Stock…

Far Bigger Than Nvidia”

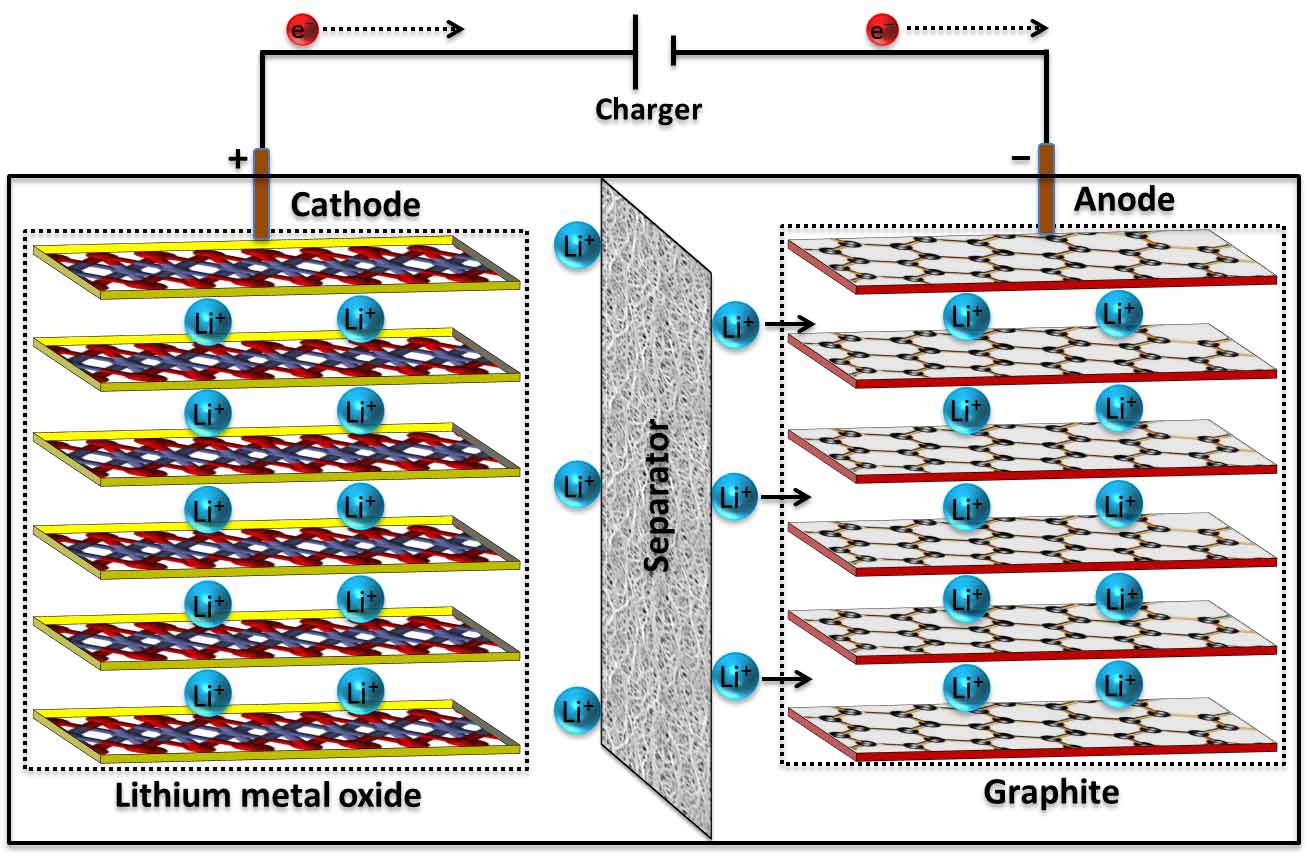

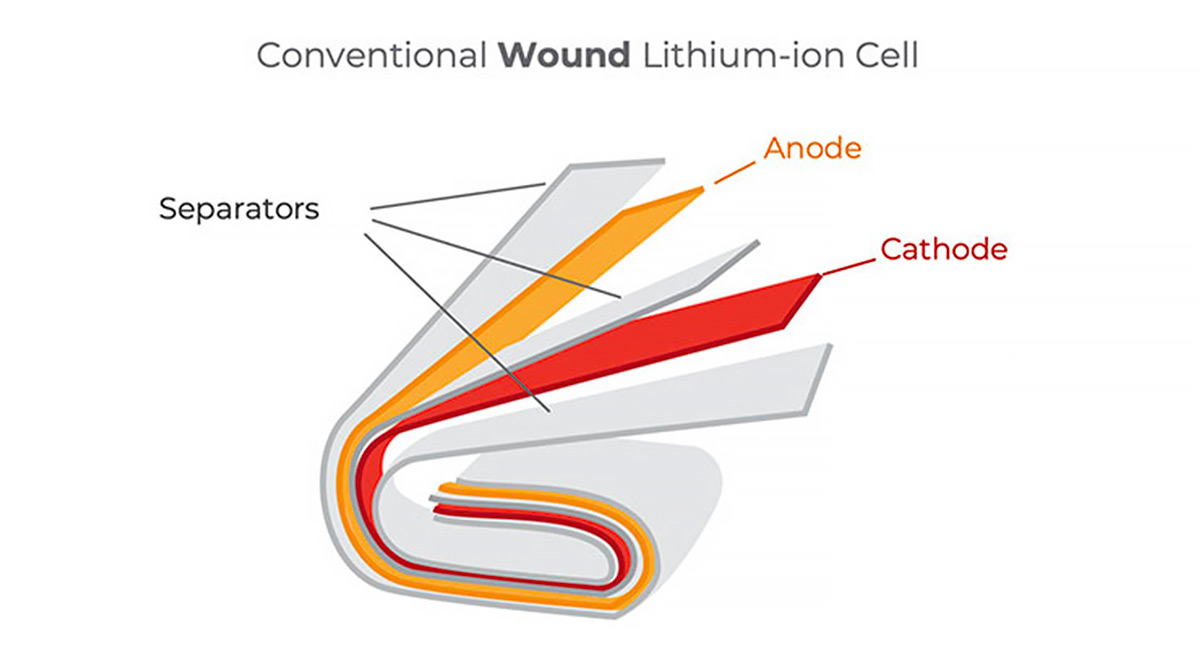

A typical lithium-ion cell looks like this. There’s a lithium metal oxide cathode and a graphite anode.

Typically, strips of cathode, anode, and separator are wound together to make today’s lithium-ion battery cells.

The coil of strips is then put in a polymer pouch or metal can, and filled with a liquid lithium electrolyte that flows back and forth from the anode and cathode through the separator during the charge and discharge process.

No other technology has been able to match it.

This company isn’t trying to re-invent the lithium-ion wheel.

Instead, it changes how the battery’s cells are made to improve them.

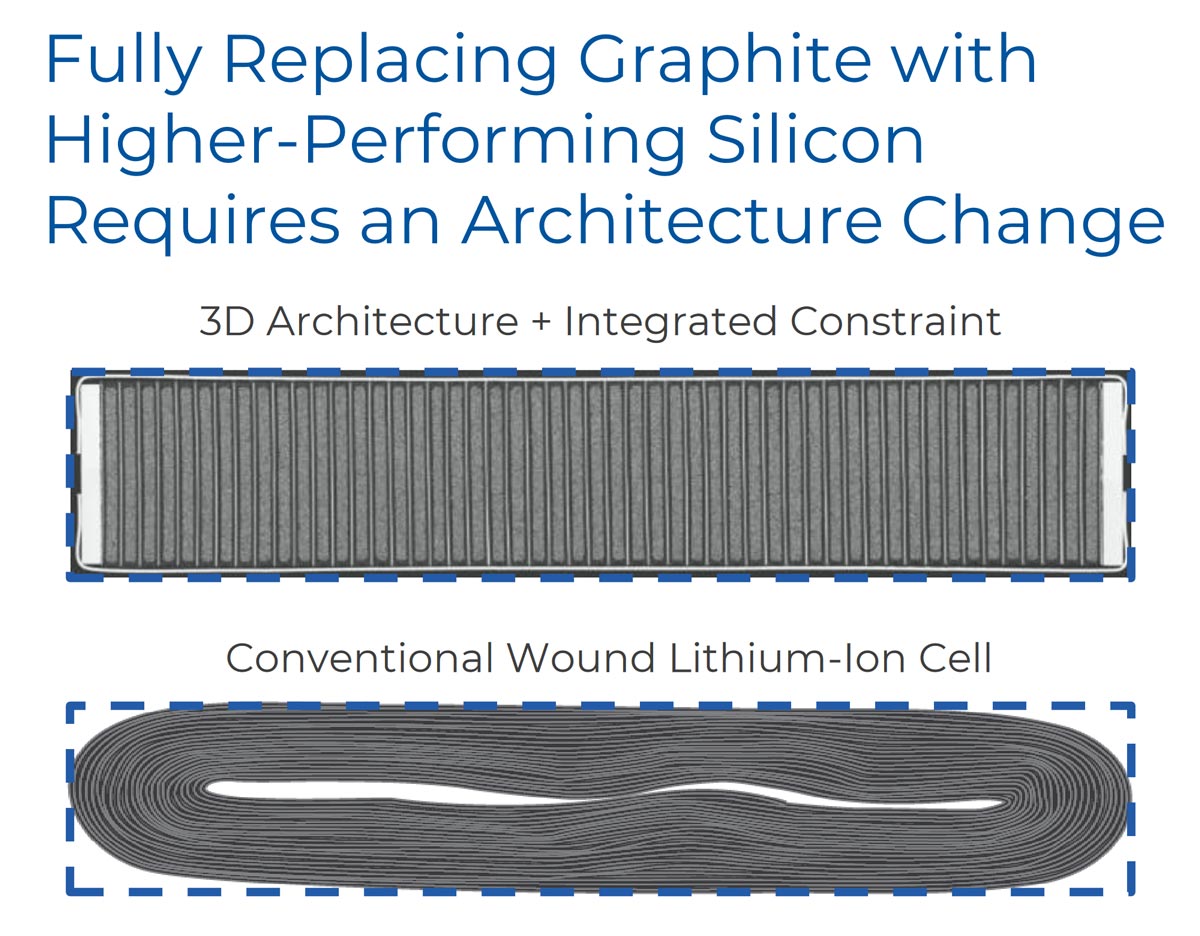

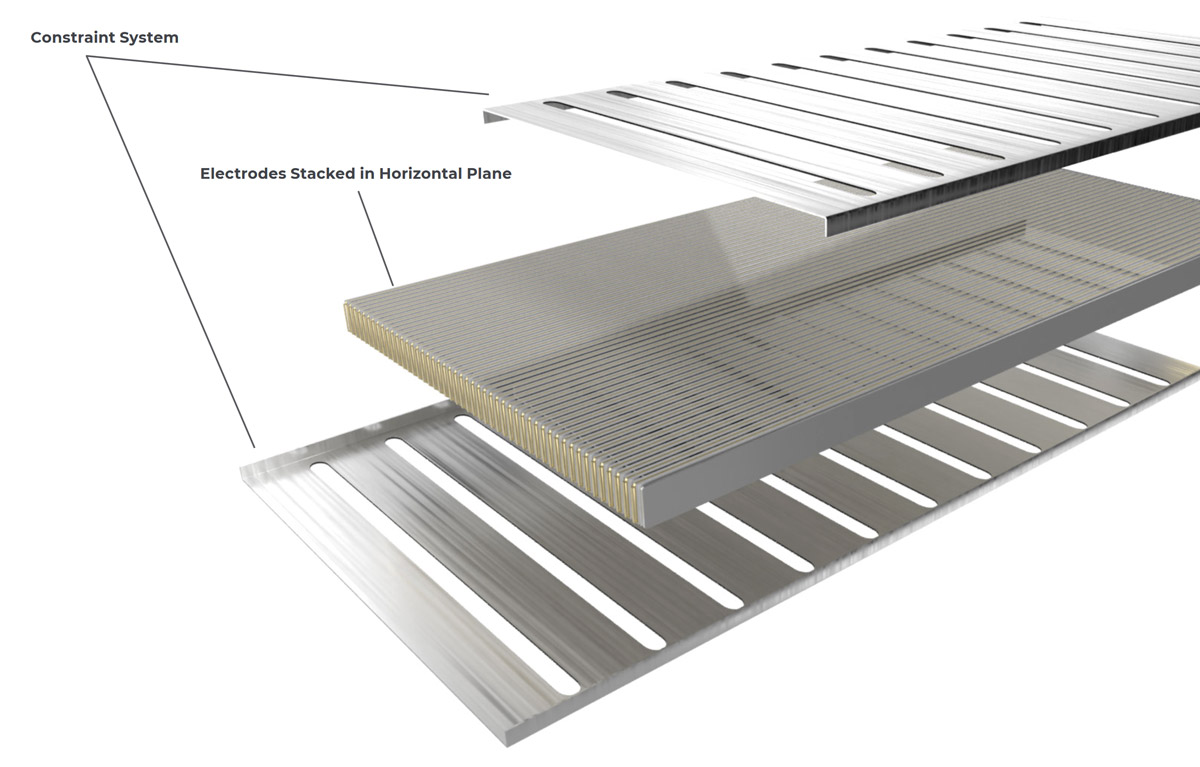

It does this by using a novel 3D cell architecture in which cathodes, anodes, and separators are precisely laser-patterned and stacked side-by-side.

It’s a much more efficient use of space. And that increases energy density.

And each of those cells is contained as opposed to one continuous coil, so any fires are contained to the individual cell.

The company also eliminates the graphite in the battery by incorporating this black powder right here into the anode:

It’s not a rare earth metal. And it isn’t some hard-to-process mineral compound.

It’s cheap and easy-to-find silicon, which can hold twice the amount of lithium as a graphite anode.

And it can do this because of the stacked cell structure. The coils in use today can’t use silicon in the anode because it expands and can’t be contained.

So the same innovation that solves the fire problem and allows for higher energy density, also allows for silicon to be used in the anode.

It all leads to a dramatic increase in performance that is much-needed for the emerging mobile battery market in cell phones and beyond.

New applications like deep learning and artificial intelligence are chewing through laptop batteries.

Some new cell phones and tablets need flexible technology.

And virtual reality headsets need to last entire games or Oscar-length epics without needing to plug in.

These cells last longer. They also provide more power in the same or less space.

That’s why after diligent testing, the US Army placed a purchase order this year to use them in soldiers’ ‘wearable batteries’.

And these cells are getting better every day.

Certainly at a pace that will dwarf the growth of the last 40 years.

Even better…

This technology is protected by 94 different patents … giving this little-known company the KEY to unleashing it all.

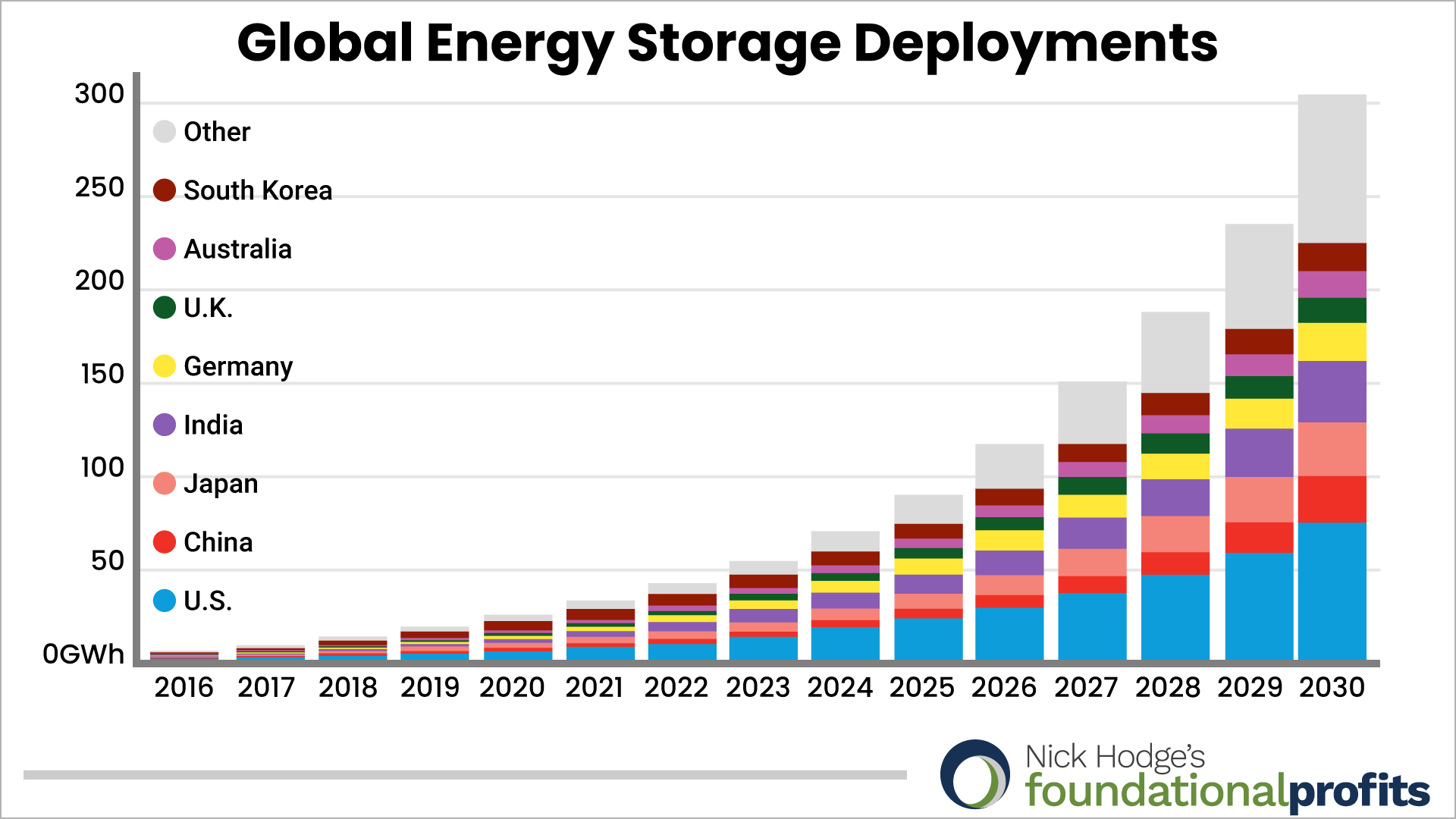

All told, Bloomberg projects battery power to “double six times” by 2030.

And these new cells will no doubt play a major part in the growth.

But what does a leap forward in battery technology mean for you?

The Biggest Battery

Transformation in 40 years

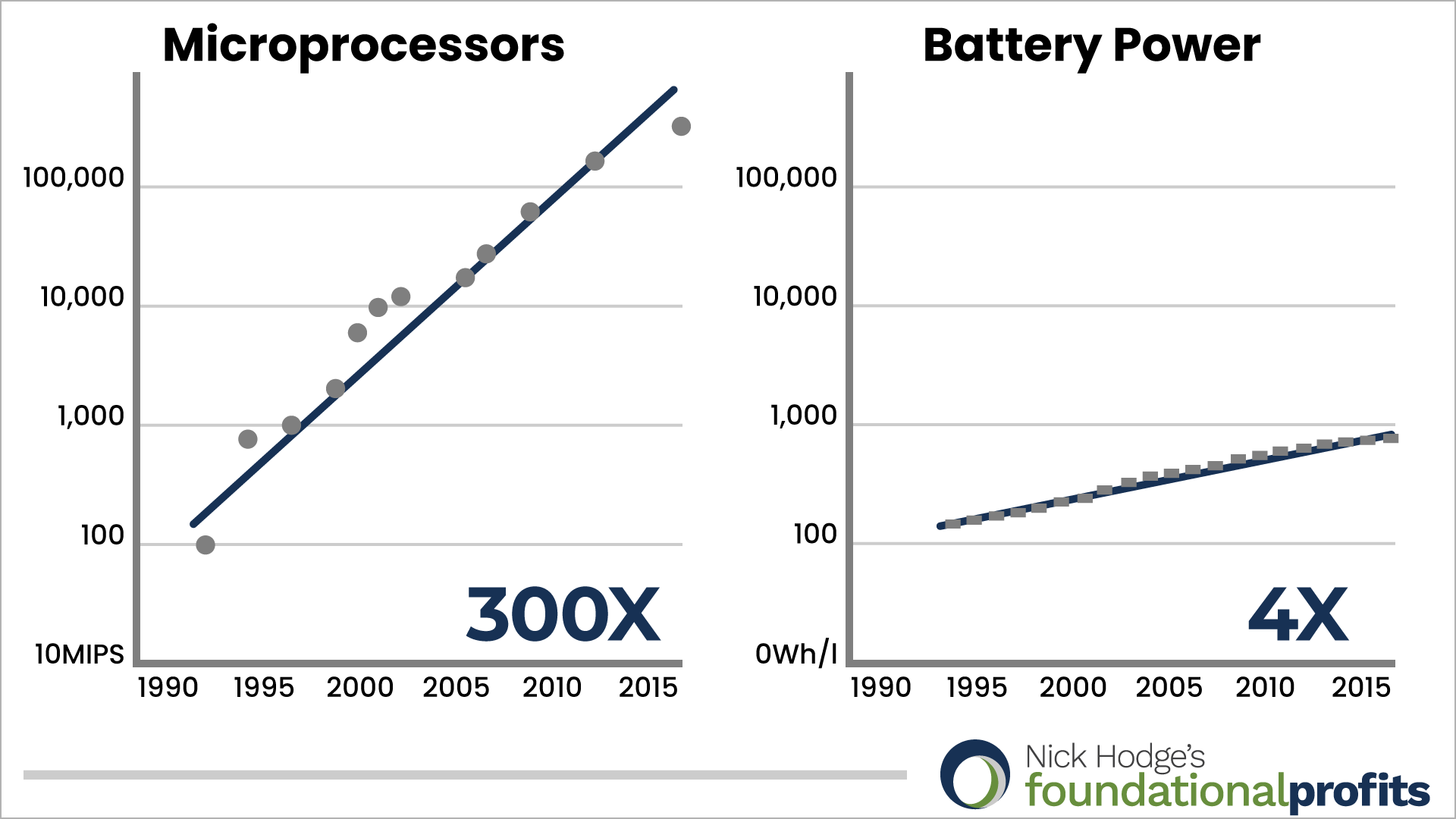

You see, for the last 40 years, our technology has grown in leaps and bounds.

But our batteries? They’ve gone nowhere.

For example … when compared to microprocessors that have surged 300 times in speed and power...

The growth in battery power is virtually nothing.

Changing that improvement curve for batteries could mean microchip-like profits for investors who get in now…

What Intel Did to Microchips Is What

This Company Is Doing to Batteries

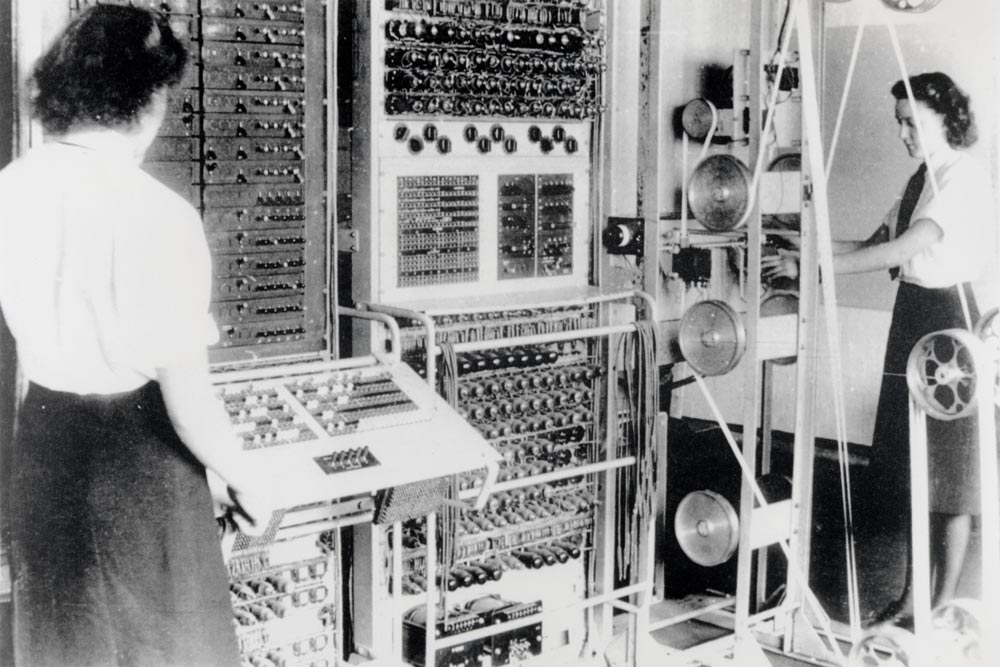

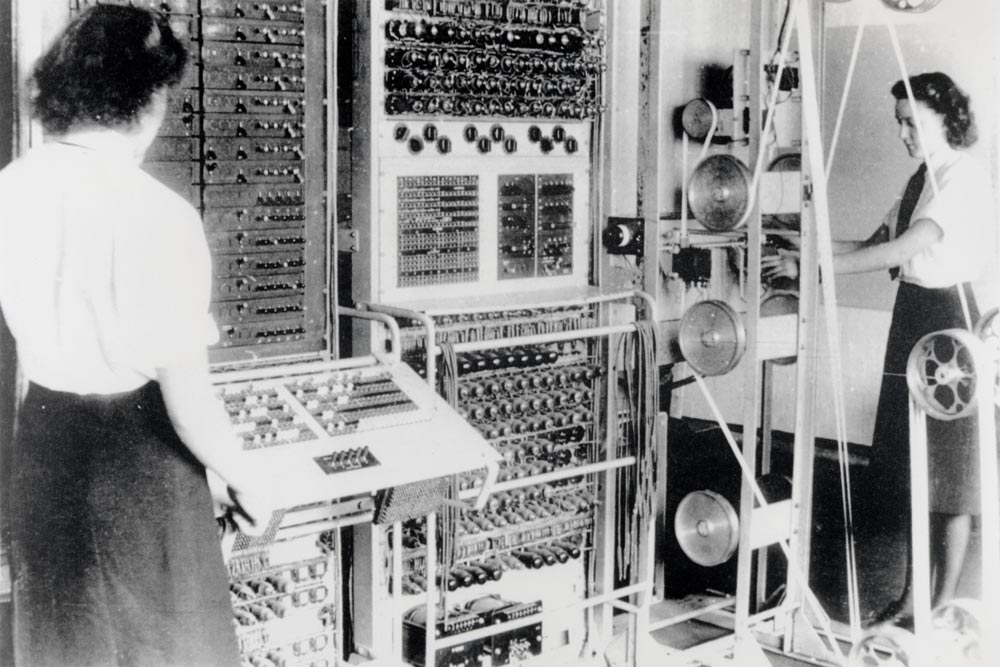

The last time we saw an innovation so powerful was the microchip, which was invented in 1959.

But it didn’t gain traction until more than 30 years later, when Intel revolutionized chip technology with the invention of the MOS transistor, putting chips in all devices we now use.

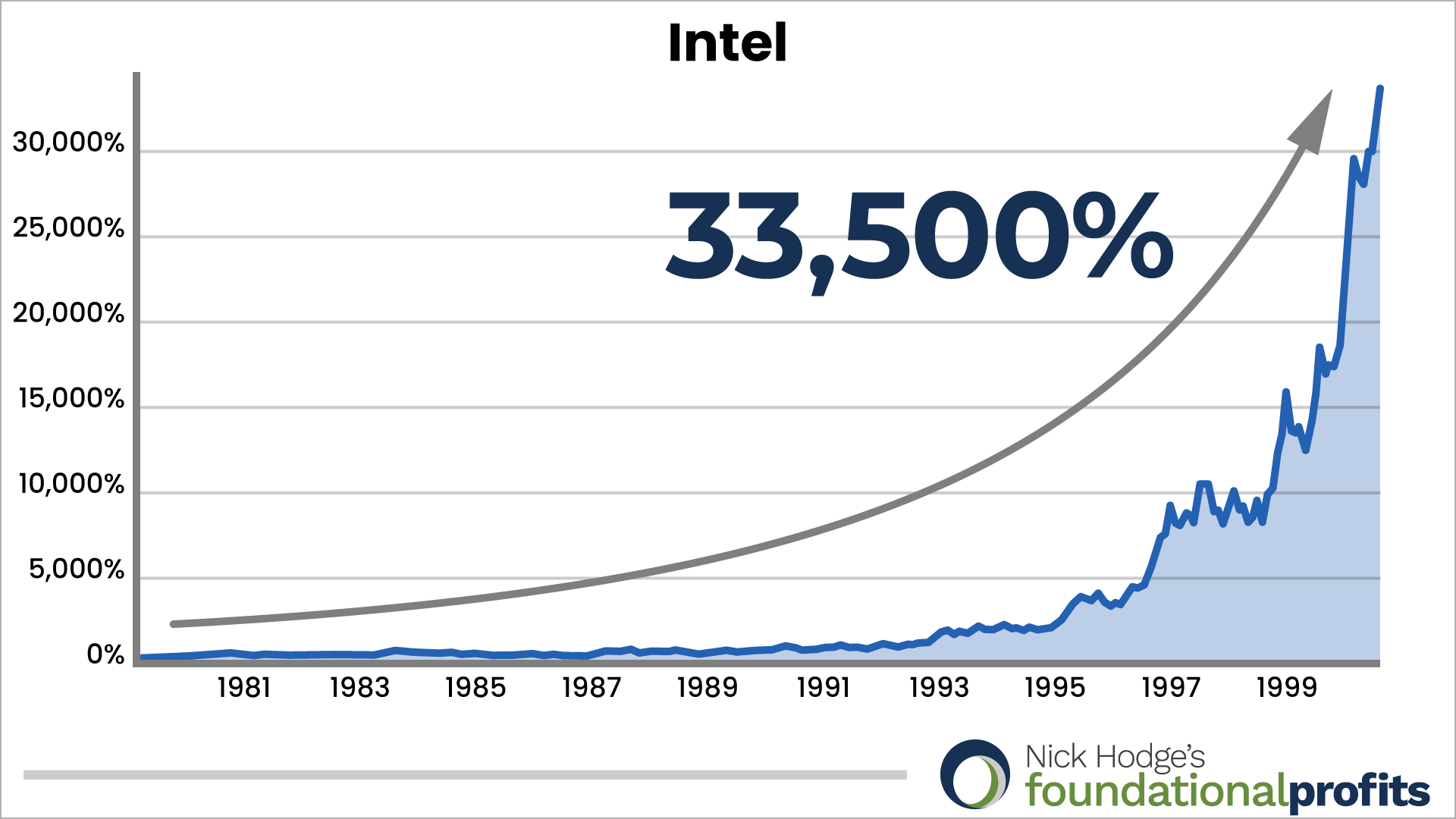

Of course, Intel made early investors rich, soaring for 33,500% gains over the 1980s and 1990s...

This new lithium-ion battery cell company is doing to batteries what Intel did to microchips.

When Intel came around, the chip had maybe a dozen or so “transistors,” which is the technology that controls the size and power of the processor.

Which is why — similar to current EV batteries —microchips were big, bulky and only worked for giant computers like this…

But Intel’s breakthrough, the MOS transistor, set in motion what’s called Moore’s Law… meaning that the number of transistors would at least double every single year.

Nowadays, the average chip has billions of MOS transistors, which has made all of our technology so much smaller and so much cheaper. They’re even called “the fundamental building block of electronics.”

It enabled them to condense the same computing power in the palm of your hand…

And Intel’s discovery spun off a whole bunch of major chip stock gains, including…

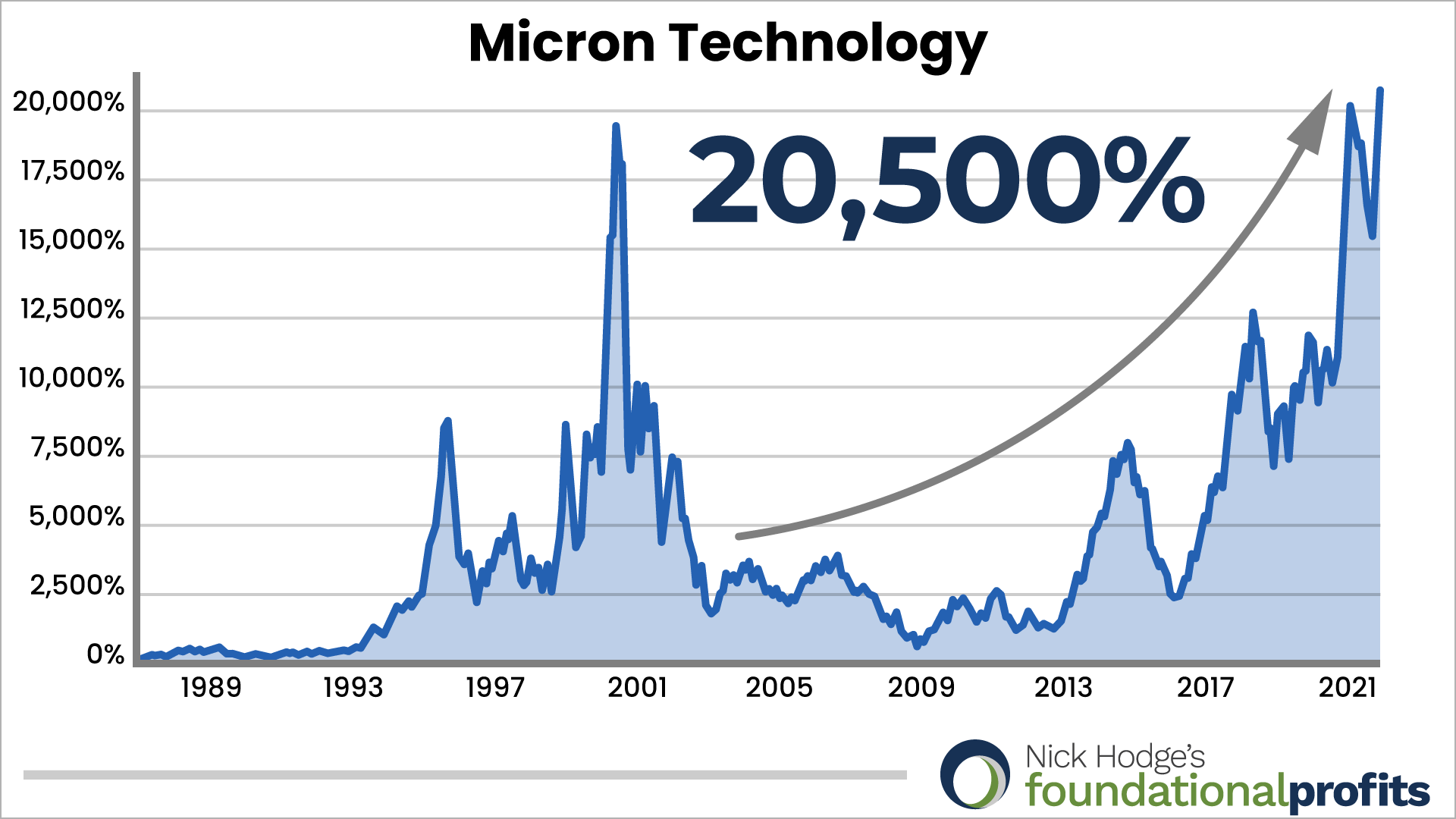

Micron Technology, which jumped 20,500%...

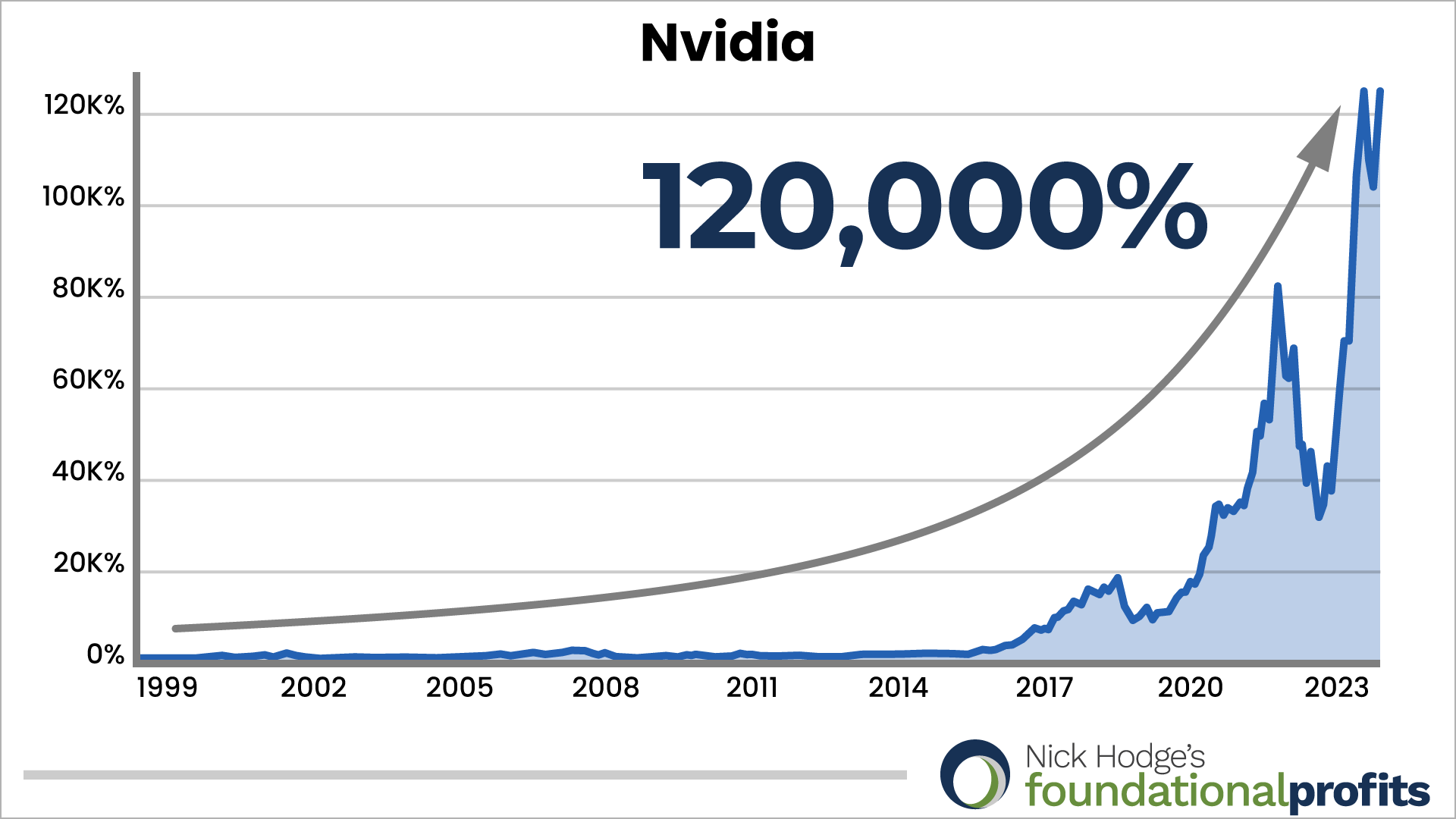

Nvidia, which skyrocketed 120,000%...

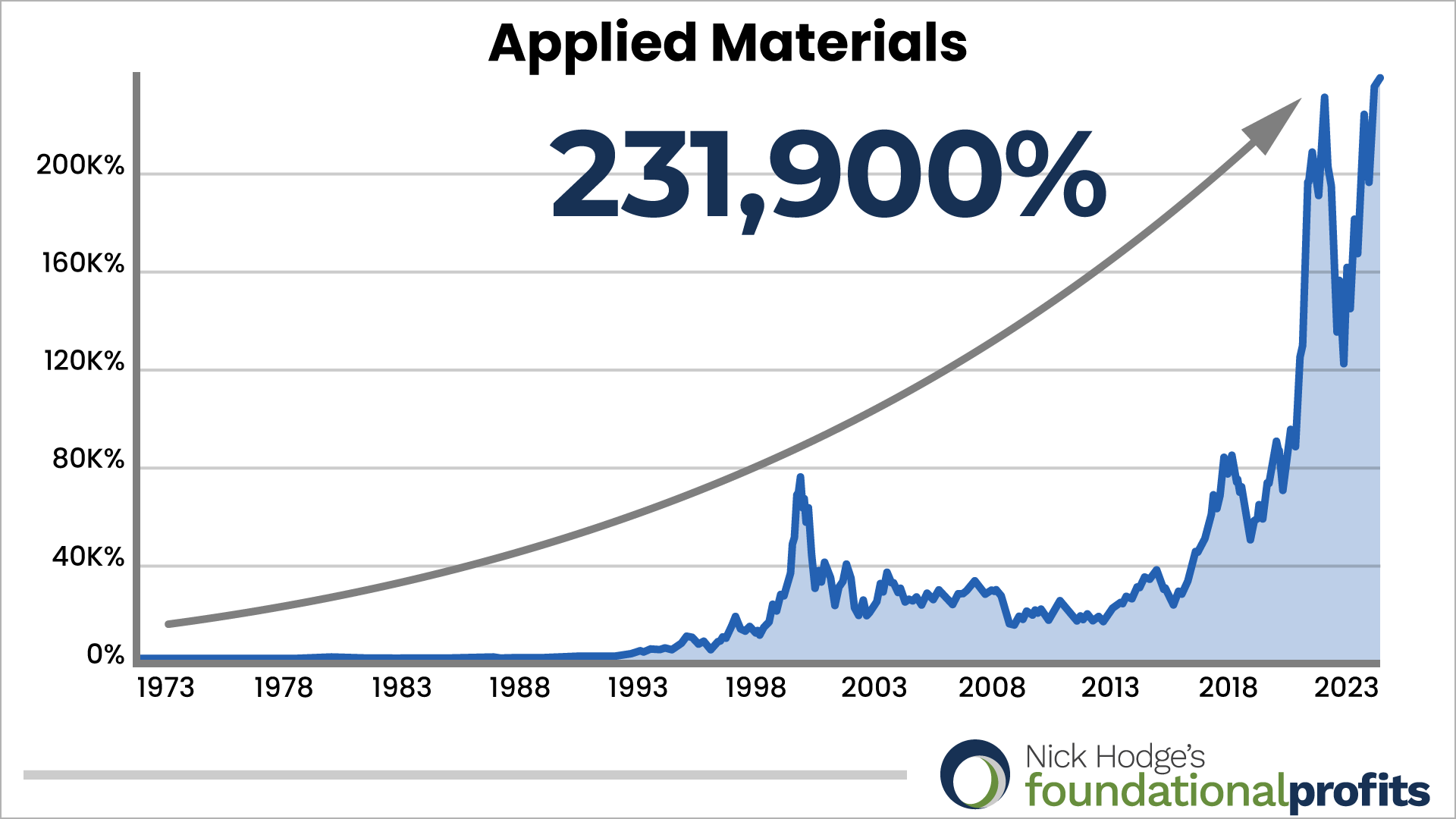

And the best example may be Applied Materials — the world’s No. 1 equipment supplier to chip companies.

It’s NOT a chip stock.

It has a technology that, for the last three decades, accelerated chip adoption at an exponential rate.

Before their innovation, chips were made for one computer at a time.

This became slow and cumbersome, especially in the 1980s, when computers began taking off.

What Applied Materials did was make mass production of microchips — with silicon — possible.

And the good news is this company has had the biggest gains of all — surging by an extraordinary 231,900% over the course of its life.

Just $100 invested in Applied Materials could have made you a millionaire.

That’s the kind of gain potential we’re seeing today being created by the company that will accelerate battery adoption.

It’s more than a cherry-picked comparison.

The leading execs and engineers of companies like Qualcomm, Micron, and AMD…

Companies that introduced the chips powering all of our modern technologies…

They are now sitting on the board of this tiny company as it brings the same innovation to batteries…

And the same way they used silicon to revolutionize the way we store information…

They are now using it to revolutionize the way we store energy.

This is why it’s being called the “Nvidia of Batteries.”

And just as we once saw an exponential growth in chip storage for our devices…

This is going to launch exponential growth in the batteries powering these same devices - our home appliances, phones, and EVs.

The Silicon Revolution in Batteries Will

Generate Semiconductor-Like Gains

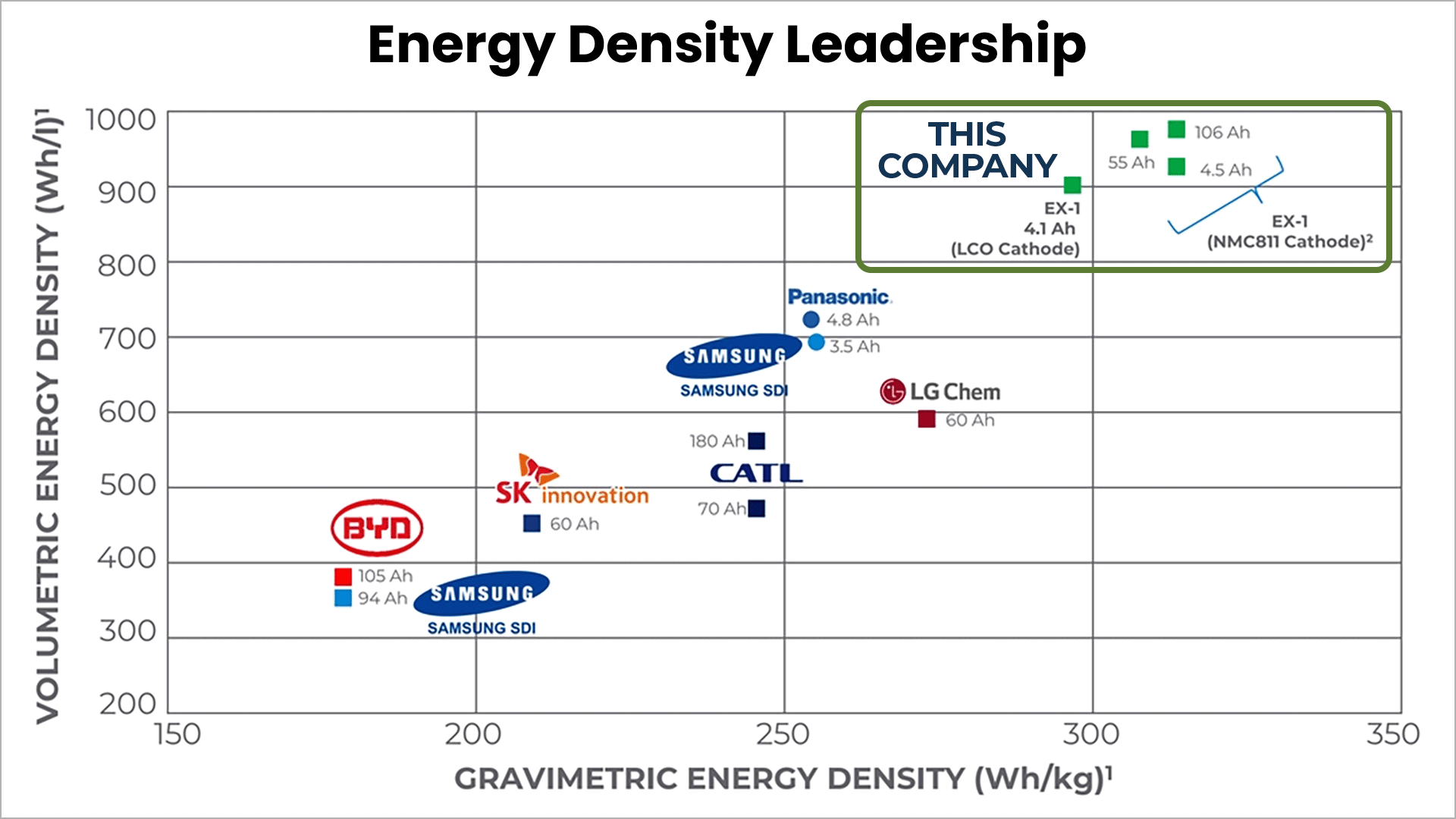

As I said before, silicon absorbs two times more lithium ions than graphite…

This gives the battery an unprecedented boost in energy density.

And remember…

Power storage is all about containing energy.

Which is why everyone from Elon Musk to Bill Gates has been racing for this battery “holy grail.”

“Porsche, Mercedes and GM are betting on silicon anode batteries” — CNBC

“The silicon era is now here… for batteries.” — IEEE

The problem though is…

When silicon absorbs lithium ions during charging, it expands.

During the discharge cycle, when the battery’s powered on, the silicon releases the lithium ions and shrinks back down again.

The changes in size fracture the battery after a few cycles.

This is why…

Although everyone knows the silicon anode is the “Holy Grail” of batteries…

They’ve failed to add more than a tiny fraction of silicon to batteries.

But this company has spent over a decade working to break through this barrier…

And now they’ve finally done it.

They’ve cracked the holy grail… creating a 100% silicon-anode battery cell.

What they did was simple, as simple as Intel’s change to the microchip…

And it is just as transformative. And could be just as lucrative.

The Battery’s Fundamental Flaw… Fixed

Turns out the problem the whole time was never silicon.

It was in the very design of the battery itself.

This “roll” or “coil” design not only fails to contain silicon’s expansion… it actually aids it.

That was the fundamental flaw that held back every advance in battery tech.

But now that’s all changed…

Instead of making a replica of a typical graphite battery anode…

This company created an entirely new way to structure the battery cell…

Using thin strips of silicon that are stacked on top of one another… similar to a layered cake… that condenses the power of silicon.

The strips are held in a steel casing – like a scaffold — that holds the atoms inside.

Inside there’s room to expand and shrink...

So once the lithium ions are absorbed, the particles expand within the shell casing — but not outside.

And this leaves the outer layer of the battery’s electrode untouched ... and undamaged.

This means you get ALL of the power — with none of the changes in size that crack the battery.

It’s that simple. And thanks to this innovation...

This company has achieved what so many have dreamed of...

What Elon Musk and so many others have been rushing to do...

They’ve begun to unleash the power of silicon, for the first time ever, launching the 21st-century battery.

Already its shown to:

Fully charge in under 10 minutes…

And last over 10 years… while maintaining 93% of its capacity.

Absolutely no other battery competes.

And since this company holds no less than 94 patents on the technology...

They’ve locked in an undisputed monopoly on this record-setting breakthrough.

Right now dozens of companies are racing to bring silicon batteries to market, but only one is the leader…

THIS company.

It’s no contest.

Why is it so far in advance of the world’s most powerful battery makers?

In short, it’s NOT a battery maker.

Nor is it fundamentally changing how batteries are made.

The Super Battery of the Future…

is the Lithium-Ion Battery

Instead, its cell technology can be added to ANY existing battery…

In ANY factory.

So unlike all of its competitors…

It doesn’t have to reinvent the wheel. And it doesn’t have to do the expensive work of battery production.

It’s transforming the battery of today… The same way Intel, Micron, and Applied Materials transformed semiconductors.

It’s now unleashing the full potential of the silicon battery…

Just like Moore’s Law did for microchips…

It’s how innovations in data storage, using silicon, sent microchips from powering this…

To powering this…

That’s exactly what this company’s battery cells can achieve.

It’s why it has lined up clients from the US Army to household names like Samsung and Lenovo.

And it’s why the company’s billionaire chairman is loading up on shares. Already, he owns 14% of the stock…

In March of this year alone, he bought half a million shares. Plus thousands more since.

The company is already in production with a first-generation facility that produces 100 units per hour.

A high-speed second generation line is expected to go online in the first half of 2024. It is expected to produce at speeds ten to thirteen times faster, rolling off 1,350 units per hour.

I expect that will light a fire under the stock…

So there’s no time to waste. To get you started…

I’ve compiled all of the details on this opportunity, including videos showing how the cells are made, so you can act right away.

You can find it all in a report I call…

The True 10X Battery Breakthrough

And as I said before, you’ll get first dibs on this report the moment you become a lifetime member of Foundational Profits today.

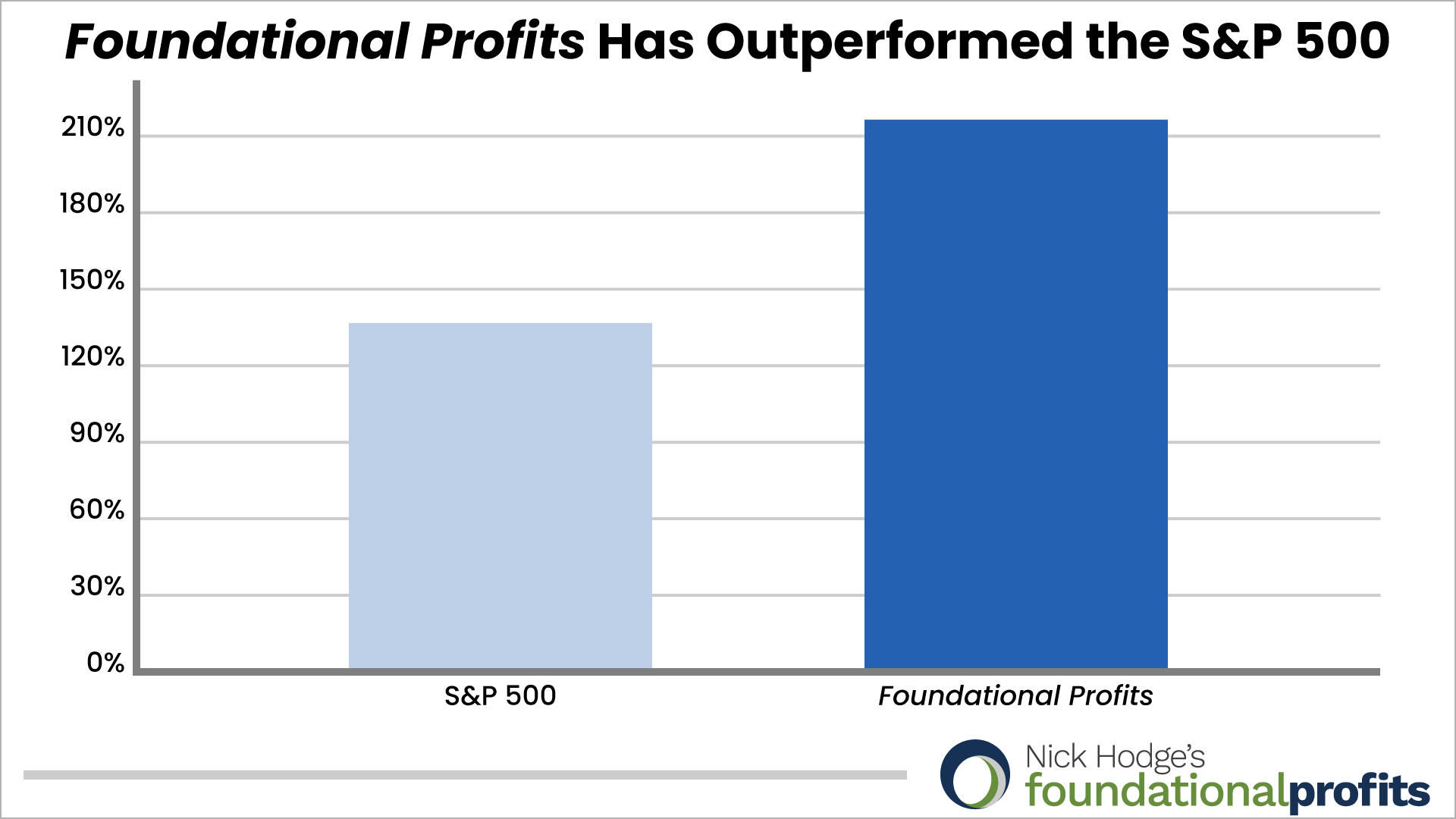

Foundational Profits Has Outperformed

the S&P 500 By 80% Over the Past 11 Years

Since the start of this publication in 2013, the closed portfolio is up just over 216%. That’s 80% more than the S&P 500, which is up 136% in the same time.

While the S&P 500 fell 20% last year in 2022...

Foundational Profits’ portfolio was up over 30%.

Most investors felt the pain of the crash, but our long-time subscribers scored gains like:

- 233% with Ivanhoe Mines

- 109% with Sibanye Stillwater

- 128% with Uranium Energy Corp.

- 122% with Franco Nevada

And in 2021, Foundational Profits led readers to more wins:

- 185% with MP Materials

- 107% with MAG Silver

- 154% with Cameco Corporation

- And many more…

In 2023, we closed winners like 66% on Allison Transmission and 21% on Altria Group. And neither of those gains include the nice dividends that those companies pay.

And I'm convinced I’m about to show readers even bigger gains over the next 12 months and beyond.

We're currently up significantly on a couple uranium positions, including the Sprott Uranium Miners ETF. Foundational Profits opened this position in May 2022 and it’s already been up more than 60%.

How did we help investors make money over the past 11 years? Including 30% portfolio gains in 2022 while the stock market had losses everywhere?

It’s because Foundational Profits gets the direction of large market cycles correct and times them efficiently enough to outpace the market.

It’s also willing to go anywhere and report on anything that shows promising value.

I am relentless when it comes to finding the best growth opportunities.

I don’t discriminate against anything.

I will travel anywhere… talk to anyone… work countless hours… and invest in companies and countries across the globe.

But what really sets me apart is that…

I buy the same investments

I recommend to my readers

I never understood analysts who refuse to “eat their own cooking.”

I’m confident about putting my long-term nest-egg money into the Foundational Profits model portfolio because our track record proves it’s a better way than the traditional 60/40 or financial advisor model.

And I even go as far as showing you how I’m allocated to positions in real-time in the monthly issues.

But I want Foundational Profits to be more transparent than any other investment research service in America.

This is why I’m hosting a live call-in webinar every quarter.

You can ask me any question you want about investing and I will answer for the benefit of all readers.

I’ll also update you about how I am personally allocating my money.

You’ll see what allocations I have in my own portfolio, and I’ll explain why I’m making changes if this is the case.

Not many analysts will show you what they are doing with their own retirement nest egg.

But this is the type of transparency all of my subscribers receive.

And you can get it for life by becoming a lifetime member today.

When you do, I’ll send you a copy of my latest briefing: The True 10X Battery Breakthrough.

I’d also like to sweeten the deal.

As a thank you for upgrading your membership, you’ll receive an exclusive bonus you won’t find anywhere else…

I’ll also send you a brand-new video report I just created called: “Nick Hodge’s Outlook for 2024: Is Your Portfolio Prepared for What’s Ahead?”

All you have to do to upgrade your membership to lifetime and receive this free bonus video is complete the form below.

And there’s still one more thing I’d like to give you…

I want to give you an instant $1,600 Lifetime Upgrade on your current subscription today

Many of the gains I just shared with you took over one year to materialize.

Right now, you only have an annual membership to Foundational Profits.

I don’t want you to miss out on my guidance, investment ideas, and analysis of the bull/bear cycles across multiple markets and commodities.

Now, the rate to renew your Foundational Profits membership for one additional year is $199.

But I want you to stay with me… Not for the next year… Or the next 5 years…

But for as long as I publish. It’s unlimited. You can even hand it down.

I’m calling it a $2,000 lifetime upgrade, and here’s why…

Since the regular cost for one year of Foundational Profits is $199…

You’d need to spend nearly $2,000 to subscribe over 10 years.

But you don’t have to spend anywhere near $2,000 to upgrade to lifetime today.

We will upgrade your membership for one payment of $399.

It’s a $1,600 savings compared to subscribers paying the annual rate…

And that’s just over the first 10 years.

The savings continue to multiply every year.

And the benefits never end…

Because you can hand down your Lifetime Membership to your next of kin.

Which means you can give the gift of financial freedom to the ones you care for the most.

You can upgrade today and never pay another annual subscription fee again…

Going forward, all I’ll ever ask you to cover is a small $9.99 annual maintenance fee, which provides necessary services to produce our research.

Once you tell us to upgrade your membership, you will receive:

- Your First Free Report: “The True 10X Battery Breakthrough” — Detailing the trillion-dollar silicon battery opportunity, its applications for everything from EV’s to AI, and the tiny $10 stock at the forefront of it all.

- Your Second Free Report: “Nick Hodge’s Outlook for 2024: Is Your Portfolio Prepared for What’s Ahead?”

- Monthly Issues of Foundational Profits For Life. This is where I track and comment on the performance of major global economies, currencies, and interest rates… and reveal how they influence stock and commodity prices. My big-picture analysis gives you peace of mind of always knowing the best investments at all times. There’s zero guesswork.

- Investment Recommendations For Life. My analysis uses fundamentals, technicals, timing, and market psychology to harness upside in the market. No sector is off limits. We’re constantly identifying cyclical trends, and we will help you profit whenever they emerge. You’ll receive specific buy and sell recommendations from me directly to your inbox so you can act decisively.

- Access To The Model Portfolio For Life. Keep track of all the buy and sell recommendations, as well as the annual portfolio gains.

- Subscriber Call-ins For Life. I host a LIVE call-in webinar once each quarter and you are invited to attend. I’ll give you an update on the current state of the macro market, cover any important updates about our portfolio, and then answer some of my reader’s most pressing questions. You can submit your own question that I’ll answer for everyone’s benefit.

- Exclusive Interviews For Life. I have the ear of many executives and thought leaders across several industries and I bring my talks with them directly to you in candid interviews. With lifetime access, you’ll never run out of new investment ideas.

- Access To A Library of Special Research Reports For Life. This includes many investment research reports, each one highlights an investment with big potential…

Remember, one year of Foundational Profits is normally $199.

But through Saturday, January 6th, 2024 you can get a lifetime membership for the regular cost of two years.

Just complete the form below to claim all your benefits.

I look forward to welcoming you as a lifetime member.

Call it like you see it,

Nick Hodge

Editor, Foundational Profits